Finding the ideal travel credit cards can be akin to discovering a hidden gem in a bustling cityscape—a rewarding pursuit that promises both practical benefits and indulgent experiences. These credit cards often transcend mere financial tools, offering a passport to a world of perks and privileges. Imagine a card that not only accumulates miles but also opens doors to airport lounges, where the buzz of departure lounges fades into tranquility. Picture earning points not just on airfare, but on everyday purchases, transforming grocery runs into points towards your next adventure. These credit cards often come adorned with features like travel insurance, shielding you from the unexpected twists of globetrotting.

Yet, the allure lies not just in what they offer, but in how they integrate seamlessly into your lifestyle. From concierge services that handle reservations and recommendations, to exclusive event access that turns a trip into a curated experience—the best travel credit cards weave convenience and luxury into every swipe. Beyond the tangible benefits, these cards evoke a sense of possibility, inviting you to dream beyond borders. They celebrate the thrill of exploration, whether you’re scaling mountains or strolling through historic cities. In essence, they embody the spirit of travel itself—a blend of anticipation, discovery, and the promise of unforgettable moments.

The Chase Sapphire Preferred® Card beckons travelers with its allure of exceptional rewards and flexibility. It’s more than a credit card; it’s a gateway to a world of seamless travel experiences. With each swipe, it earns points that translate into unforgettable adventures, whether it’s exploring cobblestone streets in Europe or diving into turquoise waters in the Caribbean.

What sets the Chase Sapphire Preferred® Card apart is its versatility. Beyond earning points on travel and dining, it offers a spectrum of perks designed to elevate every journey. From no foreign transaction fees that simplify international spending to comprehensive travel insurance that provides peace of mind, this card anticipates and meets the needs of discerning travelers. Furthermore, the Chase Sapphire Preferred® Card transcends the transactional by offering access to exclusive events and experiences, enriching your travel narrative with unique opportunities. Its concierge service stands ready to assist with reservations and recommendations, ensuring each trip unfolds effortlessly.

What makes the Capital One Venture Rewards Credit Card a favorite among globetrotters is its straightforward approach. There are no blackout dates when redeeming miles for travel, offering unparalleled flexibility. This freedom extends to booking flights, hotels, rental cars, and more, allowing travelers to tailor their journeys to their preferences. Moreover, the card enhances travel with features like travel accident insurance and 24/7 travel assistance services, providing peace of mind wherever your adventures take you. It also boasts no foreign transaction fees, ensuring that international travel remains seamless and cost-effective.

The Wells Fargo Autograph Journey℠ Card is designed to be the perfect companion for avid travelers, offering a blend of rewards and benefits that enhance every journey. Beyond its practical financial features, this card opens doors to a world of memorable experiences and seamless travel. Earning points with the Wells Fargo Autograph Journey℠ Card is effortless, with accelerated rewards on travel purchases, making it easier to accumulate points towards your next adventure. Whether you’re booking flights, hotels, or rental cars, every dollar spent contributes to your travel rewards.

What sets this credit cards apart are its focus on traveler-centric benefits. It offers comprehensive travel insurance, providing coverage for unexpected events such as trip cancellations or lost luggage. Additionally, there are no foreign transaction fees, allowing you to explore the world without worrying about additional costs. The Wells Fargo Autograph Journey℠ Card also prioritizes convenience with features like 24/7 concierge service, assisting with travel planning and reservations. Moreover, it provides access to exclusive travel experiences and perks, elevating your trips from ordinary to extraordinary.

The American Express® Gold Card stands out as a premier choice for travelers seeking both luxury and practicality. Beyond its sleek design, this card offers a host of benefits tailored to elevate every aspect of the travel experience.

Earning Membership Rewards® points with the American Express® Gold Card is seamless, particularly with its generous rewards on flights, dining, and grocery purchases. These points can be effortlessly redeemed for flights, hotels, and unique experiences, allowing cardholders to customize their travels according to their preferences. Travel perks extend beyond rewards, with benefits such as baggage insurance and access to Global Assist® Hotline, ensuring peace of mind during journeys abroad. The card’s absence of foreign transaction fees further enhances its appeal, making it a trusted companion for international travel.

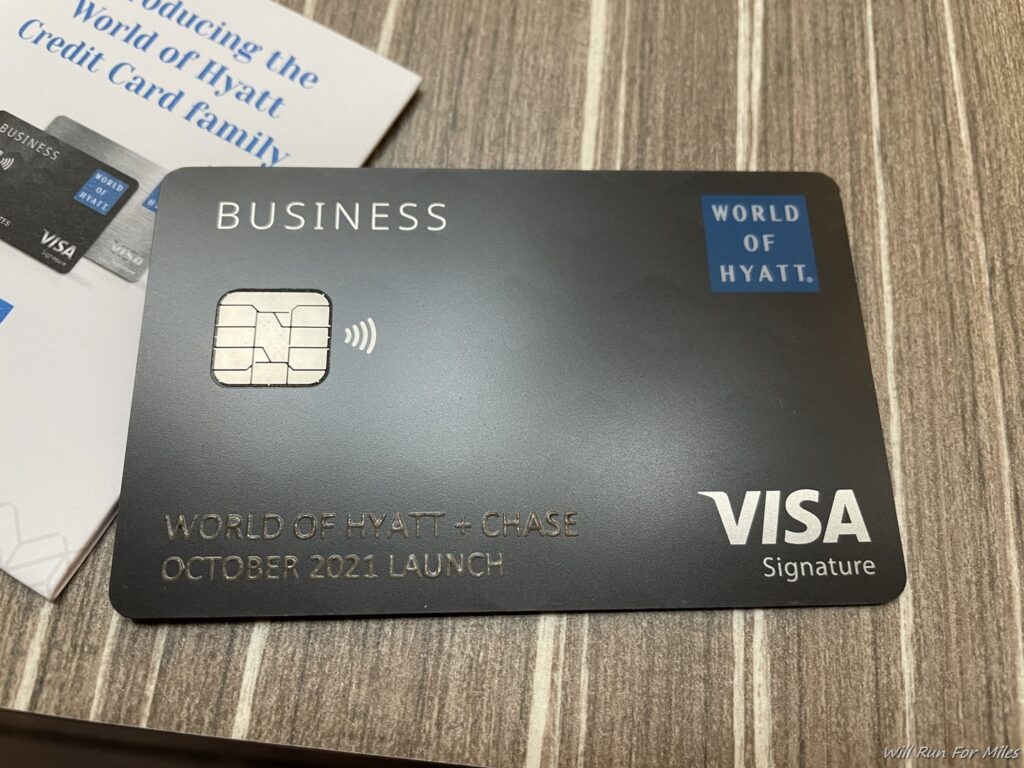

The World of Hyatt Credit Card is a must-have for avid travelers who appreciate luxury and value. Tailored specifically for enthusiasts of the Hyatt brand, this card opens doors to a world of exceptional hospitality and rewarding experiences. One of the standout features of the World of Hyatt Credit Card is its generous rewards program. Cardholders earn points not only on stays at Hyatt properties but also on dining, airline tickets purchased directly from airlines, local transit, and fitness club and gym memberships. These points can then be redeemed for free nights at Hyatt hotels and resorts worldwide, offering flexibility and value with every stay.

Beyond earning points, the card enhances the travel experience with complimentary World of Hyatt Discoverist status. This status provides benefits such as room upgrades (when available), late checkout, and a dedicated customer service line, ensuring a seamless and comfortable stay at Hyatt properties. Moreover, the World of Hyatt Credit Card offers an annual free night certificate valid at Category 1-4 Hyatt hotels or resorts, which more than offsets the card’s annual fee. This benefit makes it a standout choice for travelers looking to maximize their hotel stays without breaking the bank.